What is prizebond?

Published on: 11 July, 2023

|

2 min read

What is prizebond?

In Bangladesh, one investment avenue that has garnered significant attention and popularity among individuals is the prize bond. Prize bonds are a unique financial instrument that combines the elements of investment and chance, offering the opportunity to win substantial prizes while also serving as a safe and secure form of savings. In this blog post, we will delve into the world of prize bonds, exploring what they are, how they work, and why they have become a favored choice for many investors in Bangladesh.

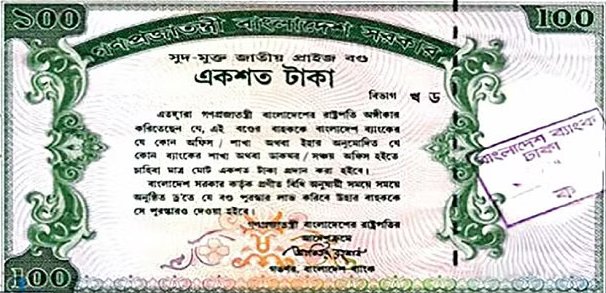

Prize bonds are essentially a type of bearer investment instrument issued by the Government of Bangladesh. They are regulated by the Bangladesh Bank, the country's central bank. Unlike other traditional investment options such as fixed deposits or stocks, prize bonds do not offer regular interest or dividends. Instead, holders of prize bonds have the chance to win prizes through periodic draws conducted by the Bangladesh Bank.

How do Prize Bonds Work?

To participate in the prize bond scheme, individuals purchase prize bonds from authorized agents or banks at their face value, which can range from 100 taka to 10,000 taka or more. Each bond is assigned a unique identification number, and this number is entered into a prize bond draw system. The draws take place at regular intervals, typically on a quarterly basis, and are conducted in a transparent and public manner.

The Prize Bond Draws

During the draws, a computerized system randomly selects winning numbers. There are several tiers of prizes, including a significant jackpot prize, along with lower-value prizes. The results of the draws are published by the Bangladesh Bank and can be accessed through official websites, newspapers, or authorized prize bond agents.

Prize Money and Taxation

The prize bond scheme offers a range of prizes, including the jackpot prize, which can be a substantial amount. The exact prize amounts depend on various factors, such as the face value of the bond and the number of bonds sold. It's important to note that the prize money is subject to income tax as per the prevailing tax laws of Bangladesh.

Safety and Security

One of the key advantages of prize bonds is the safety and security they offer to investors. Prize bonds are issued by the Government of Bangladesh, which means they are considered a risk-free investment.

Prize bonds have gained immense popularity in Bangladesh due to their unique combination of investment and chance. They offer individuals an opportunity to win substantial prizes while ensuring the safety and security of their invested capital. The prize bond scheme, regulated by the Bangladesh Bank, has become an attractive investment avenue for those seeking an alternative to traditional savings options.

It's important to note that prize bonds should not be considered as a traditional investment with guaranteed returns or interest income. The primary motivation for purchasing prize bonds is the potential to win prizes through the periodic draws.

If you are considering investing in prize bonds or participating in a prize bond scheme, it's advisable to understand the terms and conditions, prize distribution mechanism, and any associated risks. Consult with financial advisors or professionals to make informed decisions based on your financial goals and circumstances.

However, it is essential to remember that investing in prize bonds should be done with careful consideration and understanding of the associated risks and rewards.